MOOC Fundamental International Taxation(Zhejiang University)1466044164 最新慕课完整章节测试答案

1.Introduction

文章目录

Unit 1 Quiz

1、单选题:

In this example, why does the Angolan Ministry of Jordan to pay income tax?

选项:

A: The Angolan tax system identifies the source of income with the source of payment

B: The Angolan tax system identifies the place the underlying work was done

C: Income takes its source from the place of the economic activity that gives rise to it

D: Income takes its source from the place of the economic activity was done

答案: 【 The Angolan tax system identifies the source of income with the source of payment】

2、多选题:

Which of the following countries are tax havens?

选项:

A: U.S.

B: Netherlands

C: China

D: Bermuda

答案: 【 Netherlands;

Bermuda】

3、多选题:

What are the Basic Elements of International Taxation?

选项:

A: Nationality and Residence for Taxation

B: The Source of Income

C: International Transfer Pricing

D: Arm’s Length Pricing Methods

答案: 【 Nationality and Residence for Taxation;

The Source of Income;

International Transfer Pricing;

Arm’s Length Pricing Methods】

4、判断题:

Each of the two countries claims a taxpayer as a resident of their own even if they use the similar tax system,they could still have a problem of double taxation.

选项:

A: 正确

B: 错误

答案: 【 正确】

5、判断题:

Territoriality means that a country may claim that all income earned by a citizen or a company incorporated in that country is subject to taxation. The income includes domestic income and foreign income. This is because nationality is viewed as a legal connection to that country.

选项:

A: 正确

B: 错误

答案: 【 错误】

6、判断题:

Capital export neutrality (CEN) requires residents of any given nation to face the same tax burden no matter where they choose to invest. A taxpayer’s choice between investing capital at home or abroad is not affected by taxation.

选项:

A: 正确

B: 错误

答案: 【 正确】

7、判断题:

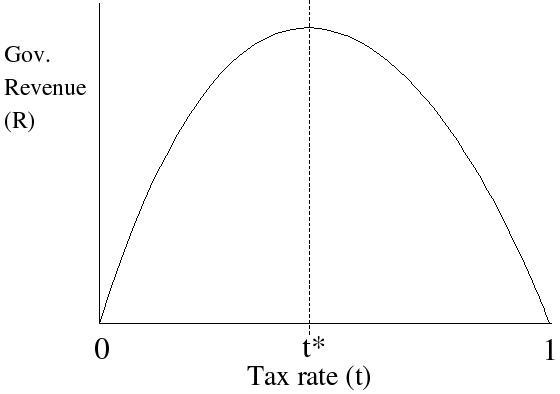

higher marginal tax rates cause individuals to have less incentive to earn more. This is the basis of the Laffer curve theory, which theorizes that population-wide taxable income decreases as a function of the marginal tax rate, making net governmental tax revenues decrease beyond a certain taxation point.

选项:

A: 正确

B: 错误

答案: 【 正确】

8、判断题:

While earnings in foreign subsidiaries are consolidated into the parent under GAAP, these earnings are not recognized as taxable income until cash is actually transferred to the domestic parent.

选项:

A: 正确

B: 错误

答案: 【 正确】

9、填空题:

_______allows U.S. taxpayers operating abroad to reduce U.S. taxes by an amount equal to any income taxes paid to other countries on foreign income.U.S. generally exempts (at least while the earnings remain abroad) from U.S. taxation the earnings of foreign subsidiaries of U.S. corporations.

答案: 【 Foreign tax credit】

随堂测验1

1、多选题:

Which of the following countries are tax havens?

选项:

A: U.S.

B: Netherlands

C: China

D: Bermuda

答案: 【 Netherlands;

Bermuda】

随堂测验2

1、多选题:

What are the Basic Elements of International Taxation?

选项:

A: Nationality and Residence for Taxation

B: The Source of Income

C: International Transfer Pricing

D: Arm’s Length Pricing Methods

答案: 【 Nationality and Residence for Taxation;

The Source of Income;

International Transfer Pricing;

Arm’s Length Pricing Methods】

随堂测验3

1、判断题:

Each of the two countries claims a taxpayer as a resident of their own even if they use the similar tax system,they could still have a problem of double taxation.

选项:

A: 正确

B: 错误

答案: 【 正确】

随堂测验4

1、单选题:

In this example, why does the Angolan Ministry of Finance require Jordan to pay income tax?

In this example, why does the Angolan Ministry of Finance require Jordan to pay income tax?

选项:

A: The Angolan tax system identifies the source of income with the source of payment

B: The Angolan tax system identifies the place the underlying work was done

C: Income takes its source from the place of the economic activity that gives rise to it

D:

答案: 【 The Angolan tax system identifies the source of income with the source of payment 】

随堂测验5

1、判断题:

Territoriality means that a country may claim that all income earned by a citizen or a company incorporated in that country is subject to taxation. The income includes domestic income and foreign income. This is because nationality is viewed as a legal connection to that country.

选项:

A: 正确

B: 错误

答案: 【 错误】

随堂测验6

1、判断题:

Capital export neutrality (CEN) requires residents of any given nation to face the same tax burden no matter where they choose to invest. A taxpayer’s choice between investing capital at home or abroad is not affected by taxation.

选项:

A: 正确

B: 错误

答案: 【 正确】

2、填空题:

_______allows U.S. taxpayers operating abroad to reduce U.S. taxes by an amount equal to any income taxes paid to other countries on foreign income.U.S. generally exempts (at least while the earnings remain abroad) from U.S. taxation the earnings of foreign subsidiaries of U.S. corporations.

答案: 【 Foreign tax credit】

随堂测验7

1、判断题:

higher marginal tax rates cause individuals to have less incentive to earn more. This is the basis of the Laffer curve theory, which theorizes that population-wide taxable income decreases as a function of the marginal tax rate, making net governmental tax revenues decrease beyond a certain taxation point.

选项:

A: 正确

B: 错误

答案: 【 正确】

随堂测验8

1、判断题:

While earnings in foreign subsidiaries are consolidated into the parent under GAAP, these earnings are not recognized as taxable income until cash is actually transferred to the domestic parent.

选项:

A: 正确

B: 错误

答案: 【 正确】

2.Nationality and Residence for Taxation

Unit 2 Quiz

1、多选题:

Which of the following belongs to the taxpayer

选项:

A: corporation

B: citizen

C: administrative organs

D: resident

答案: 【 corporation;

citizen;

administrative organs;

resident】

2、多选题:

Which of the following persons are exempt individuals?

选项:

A: full-time diplomats

B: consular officials

C: teachers

D: trainees

答案: 【 full-time diplomats;

consular officials;

teachers;

trainees】

3、多选题:

The international reaction to tax havens has focused on the OECD, which in 1998 introduced what was then known as its Harmful Tax (OECD, 1998), and is now known as its Harmful Tax Practices initiative.This report sets out the criteria for determining a harmful preferential tax regime in OECD countries and a tax haven.The main factors for being a tax haven are :

选项:

A: no or only nominal effective tax rates

B: lack of effective exchange of information

C: lack of transparency

D: absence of a requirement of substantial activities.

答案: 【 no or only nominal effective tax rates;

lack of effective exchange of information;

lack of transparency;

absence of a requirement of substantial activities.】

4、判断题:

For the bona fide residence test,the intention and the purpose of your trip doesn’t matter.

选项:

A: 正确

B: 错误

答案: 【 错误】

5、判断题:

Strict 183-day rule takes into account not only time spent in the US during the calendar year, but also days spent in the two preceding calendar years.

选项:

A: 正确

B: 错误

答案: 【 错误】

6、判断题:

Partnership pays corporate income tax.

选项:

A: 正确

B: 错误

答案: 【 错误】

7、判断题:

Indirect Foreign Credits arise when the U.S. parent gets credit for fo